Navigating Uncertainty in Transatlantic Security

“If anyone thinks that the European Union, or Europe as a whole, can defend itself without the US, keep on dreaming.” With this blunt warning, NATO Secretary General Mark Rutte captured the core reality facing Europe today: despite years of debate about strategic autonomy, transatlantic security remains deeply interdependent. His words set the tone for a renewed, uneasy conversation about European defense as Donald Trump’s return to the White House reshapes expectations for America’s role in NATO. This discussion is crucial for understanding NATO’s Future.

Trump’s re-election has reignited familiar tensions within the alliance. During his first term, he repeatedly criticized NATO members for underinvesting in defense, arguing that the United States was carrying a disproportionate burden. That pressure undeniably produced results. Since 2014, European NATO members have steadily increased defense spending, with many moving closer to the alliance’s 2% of GDP benchmark. Several countries in Central and Eastern Europe have already met or exceeded that target, driven in part by the security shock of Russia’s war in Ukraine. Trump’s supporters point to these numbers as proof that his hardline approach strengthened NATO by forcing allies to take responsibility.

Yet alongside this praise lies persistent anxiety. Trump’s “America First” rhetoric raises fears of U.S. isolationism and conditional security guarantees, concerns that resonate more strongly today amid escalating global threats. Russia’s ongoing aggression in Ukraine has underscored Europe’s military dependencies, particularly on U.S. intelligence, logistics, air defense, and nuclear deterrence. At the same time, China’s growing global influence, from technology and supply chains to Arctic and maritime interests, adds another layer of strategic complexity that Europe cannot address alone.

This moment, therefore, is not simply about defense budgets or political personalities. It is about whether NATO can adapt to a world in which U.S. leadership is more transactional, Europe seeks greater autonomy, and geopolitical competition is intensifying on multiple fronts. While Europe’s military capabilities have improved, the numbers still reveal a sobering truth: progress does not equal independence. The alliance’s strength has always rested on collective commitment, not unilateral capacity. Ultimately, these dynamics will shape NATO’s Future.

As transatlantic debates resurface under Trump’s renewed leadership, the central question is no longer whether NATO is relevant, but whether its members can recalibrate their roles without weakening the unity that has underpinned European security for over seven decades.

Historical Context: NATO’s Evolution and the Burden-Sharing Debate

The North Atlantic Treaty Organization (NATO) was founded in 1949 as a collective defense pact designed to deter Soviet expansion and stabilize a war-torn Europe. Anchored in Article 5, the principle that an attack on one ally is an attack on all, NATO quickly became the cornerstone of transatlantic security during the Cold War. For four decades, its primary mission was clear: contain the Soviet threat through deterrence, forward deployment, and close coordination between the United States and its European allies.

With the end of the Cold War, NATO’s role evolved rather than diminished. The alliance expanded eastward, incorporated former Warsaw Pact countries, and adapted to new security challenges. By the early 2000s, NATO operations increasingly focused on crisis management, counterterrorism, cyber defense, and hybrid warfare, most visibly in Afghanistan after the 9/11 attacks. However, as the threat landscape diversified, a long-standing issue resurfaced with greater urgency: uneven defense spending among allies.

This burden-sharing debate came to a head during Donald Trump’s first presidency. Trump repeatedly criticized NATO members for “freeloading,” arguing that many European allies relied excessively on U.S. military protection while underinvesting in their own defense. Although his rhetoric was controversial, it echoed concerns that had long existed within NATO. These concerns were formally addressed at the 2014 Wales Summit, where allies committed to spending at least 2% of GDP on defense and allocating 20% of that spending to major equipment and modernization.

At the time, the gap was stark. In 2014, only three NATO members met the 2% target, highlighting Europe’s deep reliance on U.S. capabilities. Since then, sustained political pressure—intensified by Russia’s actions in Ukraine and renewed U.S. demands—has driven measurable change. Today, a majority of NATO allies meet or are close to the 2% benchmark, with some pledging even higher levels of investment. Looking ahead, discussions around a 5% commitment by 2035 reflect how dramatically the conversation has shifted.

These developments underscore NATO’s adaptability. Burden-sharing is not merely an accounting exercise; it is central to alliance credibility, deterrence, and mutual trust. Understanding this historical trajectory helps explain why defense spending remains at the heart of NATO’s future—and why it matters for collective security.

Visual suggestion: A timeline graphic showing key milestones, from NATO’s founding in 1949 to the 2014 Wales Summit and today’s higher spending commitments, can help readers quickly grasp how the burden-sharing debate has evolved.

Key Statistics on NATO Defense Spending in 2025

Complex numbers reveal how profoundly NATO’s defense posture has shifted over the past decade. For readers searching for “NATO spending 2025,” the data below highlights both Europe’s progress and the alliance’s continued reliance on U.S. capabilities.

| Country / Group | 2025 Estimated Defense Spending (USD Billion) | % of GDP | Key Notes |

|---|---|---|---|

| United States | 980 | 3.21% | Dominates with ~62% of total NATO spending. |

| Germany | 93.7 (2024 data) | ~2.5% | Largest increase in Europe; up ~24% year-over-year. |

| United Kingdom | 84.2 | ~2.1% | Third-highest spender in NATO. |

| Poland | ~25 (est.) | 4.12% | Highest share of GDP devoted to defense in NATO. |

| European Allies + Canada (Combined) | ~608 | ~2.02% (2024) | Up from 1.43% in 2014; total NATO spending ≈ $1.59 trillion. |

What the numbers show

First, the 2% benchmark has become the norm rather than the exception. In 2014, only a handful of allies met the target; by 2025, virtually all do, with several, most notably Poland, far exceeding it. This shift reflects both heightened threat perceptions following Russia’s invasion of Ukraine and sustained political pressure within the alliance.

Second, the U.S. still anchors NATO’s military power. With roughly 62% of total alliance spending, Washington provides the bulk of high-end capabilities—strategic lift, intelligence, missile defense, and nuclear deterrence—that European militaries continue to lack at scale. Europe’s rising budgets narrow gaps, but they do not eliminate structural dependencies.

Third, the trajectory points higher. NATO leaders are now discussing a 5% of GDP commitment by 2035, with 3.5% earmarked for core defense and the remainder for resilience and security-related investments. Meeting that goal would require an additional ~$1.4 trillion annually across the alliance, a scale of investment that would fundamentally reshape Europe’s defense-industrial base and readiness.

Trump’s influence is evident in this acceleration. His transactional approach, linking U.S. commitment to allied contributions—did not dismantle NATO; it pushed members to treat defense spending as a strategic obligation raher than a political afterthought. Without moralizing the outcome, the data suggest a clear result: collective security has been strengthened by measurable increases in allied investment, even as debates over balance, autonomy, and U.S. leadership continue.

Rutte’s Statements: Praise for Trump Amid Warnings on Autonomy

🇺🇸🇺🇦 NATO Chief Admits European Reliance On U.S. Military

— WioTalk (@uknlp1) January 27, 2026

"Europe is now building its defense industry. And that is vital, but it cannot, at the moment, provide nearly enough of what Ukraine needs to defend itself today and to deter tomorrow.

So we all know that without this… pic.twitter.com/t5viGi1Kot

In January 2026, NATO Secretary General Mark Rutte struck a tone that was both complimentary and cautionary when discussing President Trump’s renewed influence on the alliance. On one hand, Rutte openly credited Trump for forcing a long-overdue reckoning on defense spending. On the other hand, he delivered a stark message to European leaders flirting with the idea of full strategic autonomy: going it alone would be vastly more expensive, and far riskier, than many assume.

Rutte praised Trump’s pressure campaign for accelerating NATO’s progress toward the 2% of GDP defense benchmark, noting publicly, including in posts on X (formerly Twitter), that without U.S. insistence, many allies would likely still be underinvesting. This acknowledgment is notable given Trump’s often confrontational rhetoric. From Rutte’s perspective, the outcome matters more than the style: higher spending, improved readiness, and a stronger alliance posture.

Yet Rutte paired this praise with an unmistakable warning. He argued that if Europe truly sought to defend itself without the United States, defense spending would need to rise not to 2% or even 5%, but closer to 10% of GDP. Beyond conventional forces, Europe would also face the politically and financially daunting task of replacing the U.S. nuclear umbrella. This move would require “billions” in investment and decades of strategic, legal, and ethical debate. His message was blunt: autonomy at that scale is not only costly, but destabilizing if pursued hastily.

This realism has sparked debate. Supporters view Rutte’s remarks as a necessary wake-up call, grounding abstract ideas of sovereignty in complex economics and deterrence theory. Critics, however, argue that such framing risks entrenching dependency by portraying European self-reliance as unattainable. The tension between unity and autonomy lies at the heart of this disagreement.

The implications for proposals like a standalone “European army” are significant. Existing facts suggest that while deeper coordination among EU forces is feasible, and already underway, replacing NATO’s integrated command structure, U.S. enablers, and nuclear deterrence is not a short- or medium-term option. Rutte’s intervention, therefore, does not reject European ambition; it contextualizes it. His core argument is pragmatic: Europe can and should do more, but doing more works best within NATO, not outside it.

Can Europe Stand Alone? Assessing Strategic Autonomy

The question “Can Europe defend itself?” has moved from academic debate to strategic urgency. Rising uncertainty about the long-term reliability of the U.S., intensified by President Trump’s transactional approach and episodes such as tensions over Greenland, which some analysts warn could strain interpretations of Article 5, has sharpened European anxieties. Against this backdrop, NATO Secretary General Mark Rutte’s dry response to full autonomy, “good luck,” captures the scale of the challenge rather than dismissing the ambition outright.

On the pro side of the ledger, Europe’s defense posture has undeniably improved. Military budgets are rising at their fastest pace in decades, with most NATO members now meeting or exceeding the 2% GDP benchmark. EU-led initiatives such as Permanent Structured Cooperation (PESCO), the European Defence Fund (EDF), and joint procurement efforts aim to reduce fragmentation and build standard capabilities. These steps enhance readiness, strengthen Europe’s defense-industrial base, and signal political will to shoulder greater responsibility.

However, the cons remain substantial. Capability gaps persist in areas that define modern, high-intensity warfare: strategic airlift, intelligence and surveillance, missile defense, cyber resilience, and integrated command-and-control. Most critically, Europe remains dependent on the U.S. nuclear umbrella, a cornerstone of deterrence that no European framework currently replicates. Data underline this imbalance: the United States still provides around 62% of NATO’s total military capabilities, a concentration that cannot be offset quickly through budget increases alone.

This reality does not invalidate the case for greater autonomy; it reframes it. Complete independence would require not just higher spending, but decades of coordination, political consensus, and institutional reform, along with difficult decisions on nuclear deterrence. For now, autonomy pursued in isolation risks weakening deterrence rather than strengthening it.

Yet opportunities exist to move the needle. Increased European procurement, standardized equipment, and deeper industrial cooperation can deliver real gains within the NATO framework. Investing collectively in air defense, ammunition stockpiles, and emerging technologies would reduce reliance while preserving alliance unity.

The strategic choice, therefore, is not binary. Europe does not have to choose between dependence and independence. The more practical path lies in building credible European strength that complements, rather than replaces, the transatlantic alliance, ensuring resilience even amid political uncertainty.

Broader Anxieties: Ukraine, the Arctic, and Rising Threats

Beyond budgets and burden-sharing targets, NATO’s future is being tested by unfolding crises that demand cohesion rather than complacency. Ukraine, the Arctic, and the broader spectrum of hybrid and great-power threats have become proving grounds for the alliance’s resilience in an era of political uncertainty and renewed U.S. assertiveness under President Trump.

Ukraine remains the most immediate concern. Trump’s approach, skeptical of open-ended aid and insistent on clearer burden-sharing, has raised questions about the durability of U.S. support. Yet NATO’s response suggests adaptation rather than retreat. Enhanced European defense spending, including an estimated $482 billion invested by European allies in 2024, has strengthened deterrence along NATO’s eastern flank. Increased ammunition production, forward deployments, and long-term security assistance signal that, even amid political debate, the alliance recognizes Ukraine as central to European security. The message is clear: supporting Ukraine is not charity, but a strategic investment in deterrence.

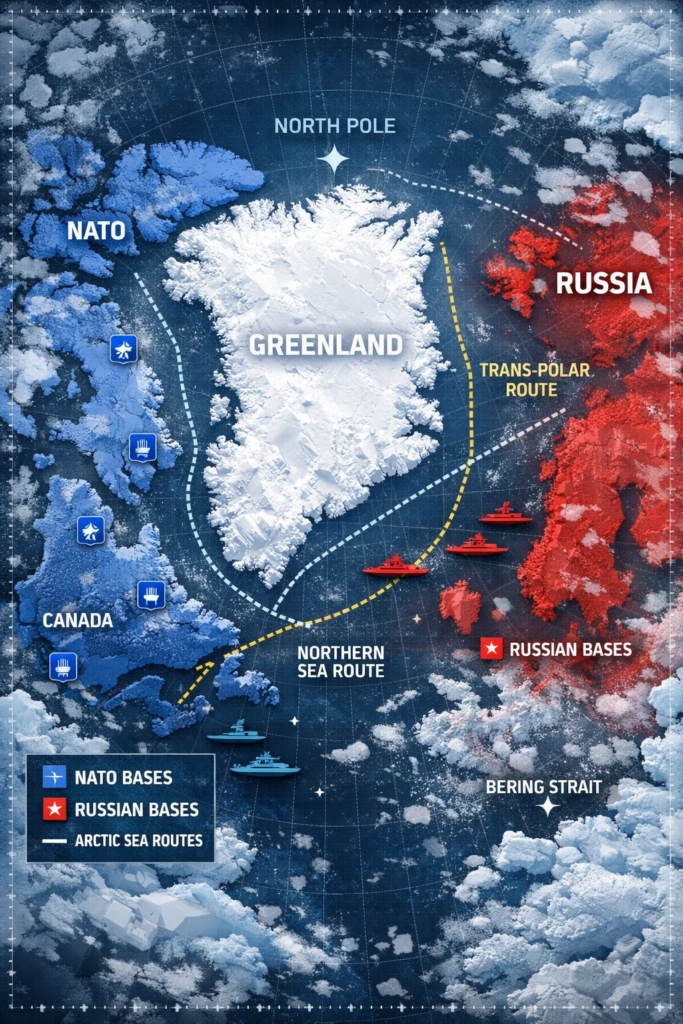

The Arctic adds another layer of anxiety. Rapid climate change is opening new sea lanes and exposing untapped resources, transforming the region into a zone of strategic competition. Greenland, in particular, has emerged as a geopolitical focal point, its location critical for missile warning systems, Arctic access, and transatlantic defense. Past U.S.–Denmark tensions over Greenland have highlighted how internal alliance disagreements can intersect with external pressures from Russia and China, both of which are expanding their Arctic footprints. For NATO, the Arctic is no longer peripheral; it is a frontline of future security planning.

Taken together, these challenges test NATO’s ability to act as a unified security provider. They also underscore why higher defense spending alone is insufficient without political alignment and strategic clarity. Trump’s policies may sharpen debates, but they also force allies to confront uncomfortable realities about readiness, responsibility, and resolve.

The broader lesson is forward-looking: unity remains NATO’s most valuable asset. Ukraine, the Arctic, and emerging global threats are stress tests for the alliance’s adaptability. How NATO navigates them will shape not only its credibility, but the broader balance of international security in the years ahead.

Future Scenarios: Strengthening or Fracturing the Alliance?

🚨EUROPE PREPARES FOR A WORLD WITHOUT AMERICA

— Jim Ferguson (@JimFergusonUK) January 12, 2026

Trump just shook the foundations of the Western order — and Europe is responding.

Behind closed doors, Brussels is now discussing a 100,000-strong joint European force.

Not NATO. Not the U.S.

A sovereign EU army designed to… pic.twitter.com/mkdGHxbdtX

Looking ahead, NATO’s trajectory in the Trump era can be framed by a set of plausible scenarios, each grounded in current trends rather than mere speculation. The alliance stands at a crossroads where decisions on spending, diplomacy, and internal cohesion will determine whether it emerges stronger or more fragmented.

The optimistic scenario builds on momentum already visible. Continued increases in defense spending, coupled with smarter investment and joint procurement, could translate budgets into real capability gains. If European allies meet the proposed 5% commitment by 2035, with a focus on deployable forces, air defense, and resilience, NATO would become more balanced without diluting U.S. leadership. In this path, Washington remains engaged, reassured by fairer burden-sharing, while Europe gains credibility as a security provider. The result is a more robust, adaptable NATO, capable of deterring Russia, managing Arctic competition, and responding to emerging threats.

A pessimistic scenario centers on political rupture. Prolonged disputes, whether over defense spending, Ukraine support, or symbolic flashpoints such as Greenland and interpretations of Article 5, could push the United States toward partial disengagement. Even without a formal withdrawal, reduced U.S. commitment would weaken deterrence and expose Europe’s capability gaps, especially in nuclear and high-end enablers. Fragmentation would invite external pressure from Russia and China, undermining the alliance’s credibility at a critical moment.

Between these extremes lies the most likely path: managed tension with incremental reform. This scenario accepts that disagreements are inevitable but treatable. Practical steps, fairer burden-sharing, more precise capability targets, and deeper European industrial cooperation within NATO can stabilize the alliance. Transparency about who provides what and for which missions would reduce mistrust while preserving flexibility.

The strategic takeaway is pragmatic. NATO does not need unanimity on every issue; it needs predictability, equity, and political will. By aligning spending with strategy and reforming without overreaching, the alliance can turn current stress into long-term strength—avoiding fracture while adapting to a more contested world.

Conclusion: Toward a Resilient Transatlantic Partnership

The debate over European defense and NATO’s future in the Trump era is often framed in stark terms: commitment versus abandonment, autonomy versus dependence. This blog has aimed to move beyond those binaries by grounding the discussion in history, data, and strategic reality. From NATO’s Cold War origins to today’s record defense spending, the alliance has repeatedly shown an ability to adapt under pressure.

Several themes stand out. Europe is spending more than ever before, narrowing long-criticized gaps and taking greater responsibility for its own security. At the same time, the numbers make clear that the United States remains indispensable, particularly in high-end capabilities and nuclear deterrence. Mark Rutte’s warnings, far from undermining European ambition, clarify the scale and cost of genuine autonomy and why cooperation still delivers the most significant security returns.

Trump’s renewed leadership adds tension, but also momentum. His insistence on burden-sharing has accelerated reforms that many allies had postponed for years. Whether this era ultimately strengthens or strains NATO depends less on rhetoric from Washington than on Europe’s response: translating budgets into capabilities, coordinating procurement, and reinforcing unity in the face of shared threats from Russia, China, and emerging arenas such as the Arctic.

The outlook is cautiously optimistic. Challenges remain fundamental and unresolved, yet they are not insurmountable. If Europe rises to the occasion and the transatlantic partnership evolves rather than fractures, NATO can emerge more balanced, credible, and resilient than before.

What do you think? Can Europe achieve meaningful autonomy without weakening NATO, or is deeper integration the safer path forward? Share your thoughts in the comments and join the conversation on the future of transatlantic security.